What Is Forensic Financial Literacy?

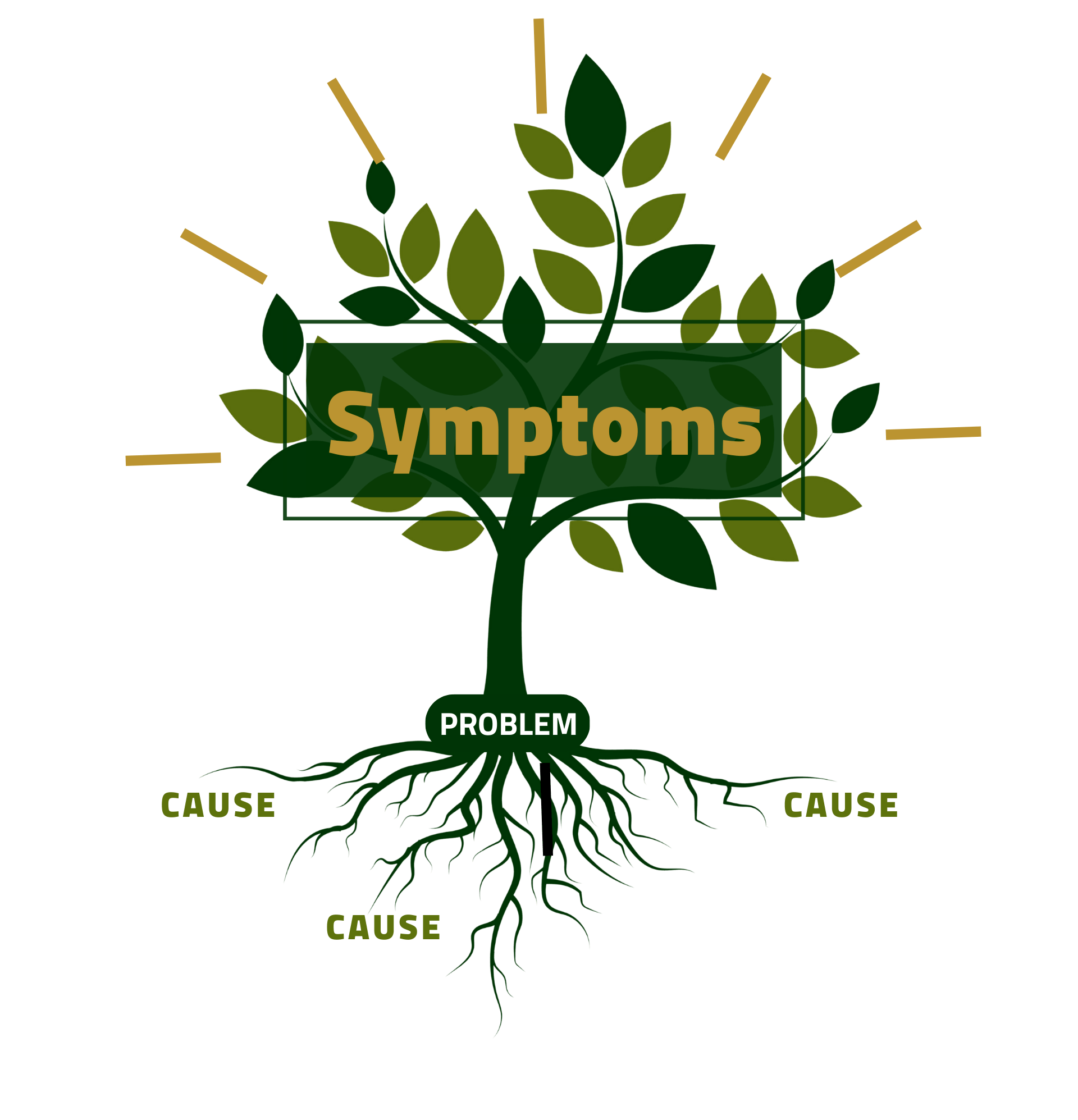

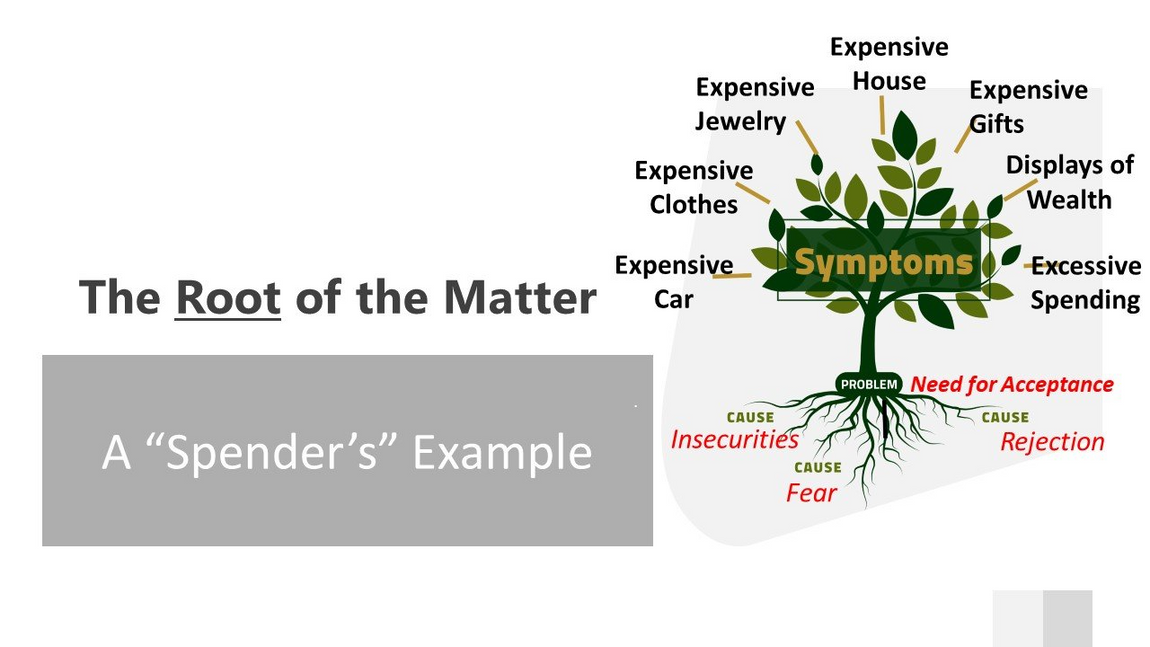

“Forensic Financial Literacy is the capacity to

investigate the financial mindset and

understand financial behaviors. The knowledge and ability to examine, diagnose, and understand the root cause(s) of financial decision making."

- Dr. Keschia Matthews

In Other Words ...

Forensic Financial Literacy breaks down why you do

what you do financially, which more likely than not,

has NOTHING to do with money!

Let us help you understand the

WHY.

Complete the inquiry form below.

Let us help you make the connection

between you, your

Present and Past Circumstances,

and why you do what you do with money.

Forensic Financial Literacy is a holistic approach to understanding personal finances.

Our team provides

comprehensive financial coaching, interventions, education, planning, management, and monitoring for our clients.

FORENSIC FINANCIAL LITERACY UMBRELLA OF SERVICES

Purpose

The purpose of Forensic Financial Literacy engagement opportunities is to assist individuals with identifying past or present experiences, situations, actions, and/or behaviors that impact today’s financial decision making.

Purpose cont.

Additionally, we will equip participants with the coping skills and tools to make informed, wise, and balanced financial decisions. Our “engagement opportunities” are interactive learning experiences that guide participants through a series of hands-on “self-discovery” activities.

Who We Serve

- Individuals / Groups from age 8 and up

- Families

- Businesses

- Schools

- Organizations

- Churches

Educational Opportunities

- One on One Coaching

- Workshops

- Seminars

- Training Series

- Lunch and Learns

Next Steps: Plan of Action

Our experts will conduct a needs assessment and customize a dynamic learning experience for you and/or your team. We don't believe in a "one size fits all" approach to learning. Every person does not think or learn the same. Accordingly, our strategically designed learning experience maximizes your ability to understand your financial mindset, establish your financial resiliency, and maintain financial stability. Obtaining holistic financial knowledge will empower you to achieve financial goals and change the trajectory of your life.

"You are never too young to start and never too old to finish!"

Forensic Financial Literacy for Every Age

| Children 5-12 | Teens & Young Adults 13-17 | Adults 18 years and up |

|---|---|---|

| What is Money? | The Root of it All Making the connection between you, your circumstances, and what you do with your money. | The Root of it All: Making the connection between you, your circumstances, and what you do with your money |

| How to use Money | Budgeting | Budgeting |

| Saving | Finances for Everyday Living | Financial Recovery: Get Your Money Back! |

| Making Money | Financial Mindset | Financial Mindset |

| Budgeting Basics | Opening and Managing a Bank Account | Protecting Your Finances: Methods and Resources that can protect you financially (401k, Unemployment Insurance, Insurance Saving Account, etc.). |

| Opening a Bank Account | Credit 101 | Creating a Financial Plan |

| Poverty Mindset vs Wealth Mindset | Your Money Personality | Credit and Credit Restoration |

| Poverty Mindset vs Wealth Mindset | Investing | |

| Money Disorders | Poverty Mindset vs Wealth Mindset | |

| Strategic Saving | Your Money Personality | |

| Money Disorders | ||

| Strategic Saving |

SPEAKERS AVAILABLE

Having a meeting, workshop, seminar, or personal development session?

Our dynamic speakers can provide information and activities for one or more of topics.

We're Here to Help you understand

Complete the inquiry form and let us help you take the mystery out of your financial decision making.

Inquire About Our Services

Or call us now